Working capital management (WCM) is concerned with the management of current liabilities and current assets. It helps a company meet its short-term obligations and operational costs. Working capital is one of the most crucial indicators of a company’s efficiency. As a result, it reflects all of the company’s liquid assets. It represents a company’s ability to meet day-to-day operating costs. Moreover, it serves as a gauge of its short-term financial health. So, to maintain a balance between liquidity and profitability, a company must plan the efficient use of its working capital. Therefore, proper working capital management is critical to a company’s core financial viability and operational performance.

Working capital management’s major goal is to ensure that the company has enough cash flow. This is to pay its short-term operating costs and debt obligations.

The difference between a company’s current assets and current liabilities is its working capital. Anything that can be quickly changed into cash within a year is considered a current asset. These are the company’s assets that are extremely liquid. Funds, accounts receivable, merchandise, and short-term investments are examples of current assets.

Management of working capital likewise incorporate constant monitoring of current, collection, and stock ratios. When resources are used efficiently as a result of working capital management, there is an increase in company’s earnings and profitability. Cash flow statement, inventory management, accounts receivables, and accounts payables are the four main operations in working capital management. Effective working capital management methods may maximize cash flow and provide large returns. Moreover, utilizing each of these components also lead to risks and expenses reduction.

Effect of Working Capital on Profitability

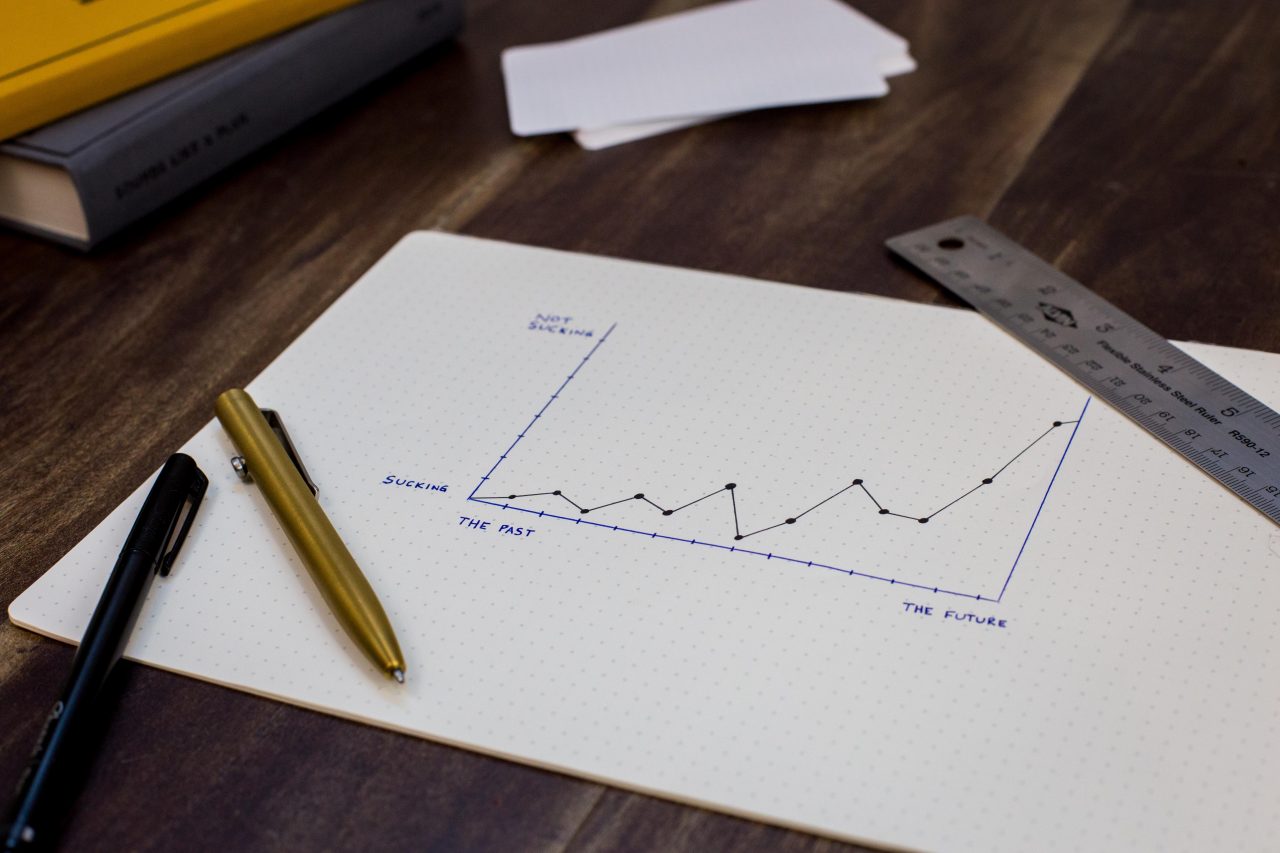

Profitability is a crucial goal of working capital management. Working capital funds typically earn little or no interest. As a result, a company with a high level of working capital may fall short of its investors’ expectations. This is for return on capital employed (Operating profit / (Total equity and long-term liabilities)).

So, there is a trade-off between liquidity and profitability. This occurs when it comes to selecting the proper quantity of working capital. There is a balance for more profitability with less working capital investment, less liquid, and effective working capital usage. A Working capital is required to keep operations running smoothly. However, it does not directly contribute to revenue growth or profitability. Having too much working capital, on the other hand, might hurt a company’s financial outcomes. This happens mostly when the funds sit idle until a liquidity need occurs. Working capital is helpful to a company’s daily operations and long-term capital investments. However, these investments should be maintained at a low level without exposing it to too much liquidity risk. Less working capital means more funding available for long-term projects and more effective operations.